Microsoft Dynamics 365 Finance exam practice materials are better at helping you prepare for the MB-310 exam. If you need useful Microsoft Dynamics 365 Finance exam practice materials to prepare for the Microsoft MB-310 exam, you can visit our pass4itsure website: https://www.pass4itsure.com/mb-310.html for the latest MB-310 exam dumps as preparation practice materials.

Rest assured, with pass4itsure MB-310 exam dumps, you will win the exam with excellent results.

Need to know the Microsoft Dynamics 365 Finance exam basics first?

That’s a must.

Give you a brief introduction to the Microsoft Dynamics 365 Finance exam. The real exam consists of 40-60 questions and needs to be completed within 2 hours. To pass the exam, you need to score 700 points out of 1000. The exam fee is $165.

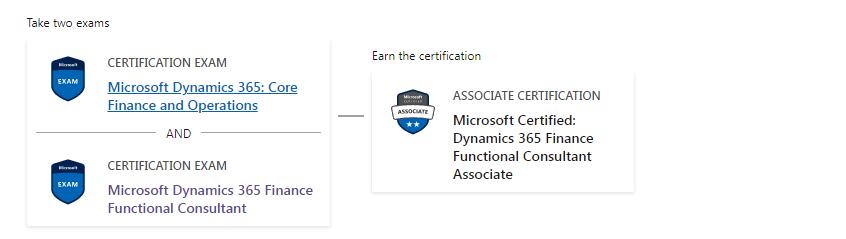

Exam MB-300: Microsoft Dynamics 365: Core Finance and Operations is associated with the MB-310 exam and you need to know about it as well.

Successfully passing the MB-300 and MB-310 exams will earn you a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate.

What useful learning materials should I pay attention to for the MB-310 exam?

- Configure and use the general ledger in Dynamics 365 Finance

- Configure and use cash and bank management, and sales tax in Dynamics 365 Finance

- Work with accounts payable in Dynamics 365 Finance

- Work with accounts receivable in Dynamics 365 Finance

- Configure and use budgeting in Dynamics 365 Finance

- Configure and manage fixed assets and Asset leasing in Dynamics 365 Finance

- Get started with cost accounting for supply chains in Dynamics 365 Finance

- Work with Expense management in Dynamics 365 Project Operations

- pass4itsure MB-310 exam dumps

How to Quickly Beat MB-310: Microsoft Dynamics 365 Finance Functional Consultant Exam?

The best way to do this is to find reliable MB-310 exam dumps, get effective Microsoft Dynamics 365 Finance exam practice materials, practice regularly, improve your exam ability, and master all the knowledge of the Microsoft MB-310 exam to win the exam.

pass4itsure MB-310 exam dumps are recommended here.

Where can I find free MB-310 exam practice materials?

Here, is the freecertexam.com blog. Free MB-310 exam practice materials are available, just below.

Of course, you can also download the free MB-310 exam questions: https://drive.google.com/file/d/1XdHOXJs48s9yezib6L5VoZ1xSbHOPfIL/view?usp=sharing

Microsoft MB-310 – Microsoft Dynamics 365 Finance Latest Questions Free

Q-1

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF). USMF plans to implement a new manufacturing department that will be based in Australia. You need to create a draft account structure for the new department. The account structure must use the same account structure as a department named Manufacturing India and be named Manufacturing Australia.

To complete this task, sign in to the Dynamics 365 portal.

Correct Answer:

You need to create an account structure with the same structure as the department named Manufacturing India by using the following instructions.

1. Go to Navigation pane > Modules > General ledger > Chart of accounts > Structures > Configure account structures.

2. On the Action pane, click New to open the drop dialog.

3. In the Account structure field, type a name to describe the purpose of the account structure.

4. In the Description field, type a description to specify the purpose of the account structure.

5. Click Create.

6. In the Segments and allowed values, click Add segment.

7. In the dimensions list, select the dimension to add to the account structure.

8. At the end of the list, click Add segment.

9. Repeat steps 6 to 9 as needed.

10. In the Allowed value details section, select the segment to edit the allowed values. For example, click the Main Account field.

11. In the Operator field, select an option, such as is between and includes.

12. In the Value field, type a value. For example, 600000.

13. In the through field, type a value. For example, 699999.

14. In the Allowed value details section, click Apply.

15. Repeat steps 10 to 15 as needed.

16. In the Allowed value details section, click Add new criteria.

17. In the Operator field, select an option, such as is between and includes.

18. In the Value field, type a value. For example, 033.

19. In the through field, type a value. For example, 034.

20. Click Apply.

21. In the grid, select the segment to edit the allowed values. For example, Cost Center.

22. In the CostCenter field, type a value. For example, 007..021.

23. In the Segments and allowed values, click Add.

24. In the MainAccount field, type a value. For example, 600000..699999

25. In the grid, select the segment to edit the allowed values. For example, Department.

26. In the Department field, type a value. For example, 032.

27. In the CostCenter field, type a value. For example, 086.

28. On the Action pane, click Validate.

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/create-account-structures

Q-2

A company uses Dynamics 365 Finance to manage budgets.

You need to reallocate funds during the year.

Which budget code should you use?

A. Carry-forward

B. Zero-based

C. Pre-encumbrance

D. Transfer

Correct Answer: D

Q-3

You are configuring the year-end setup in Dynamics 365 Finance. You need to configure the year-end setup to meet the following requirements: The accounting adjustments that are received in the first quarter must be able to be posted into the previous year\\’s Period 13. The fiscal year closing can be run again, but only the most recent closing entry will remain in the transactions. All dimensions from profit and loss must carry over into the retained earnings. All future and previous periods must have an On Hold status.

Solution:

Configure General ledger parameters.

–

Set the Delete close of year transactions option to No.

–

Set the Create closing transactions during transfer option to No.

–

Set the Fiscal year status to permanently closed option to No. Define the Year-end close template.

-Designate a retained earnings main account for each legal entity.

–

Set the Financial dimensions will be used on the Opening transactions option to No.

–

Set the Transfer profit and loss dimensions to Close All. Set all prior and future Ledger periods to a status of On Hold. Does the solution meet the goal?

A. Yes

B. No

Correct Answer: B

Q-4

You are configuring the year-end setup in Dynamics 365 Finance. You need to configure the year-end set up to meet the following requirements:

The accounting adjustments that are received in the first quarter must be able be posted into the previous year\\’s Period 13. The fiscal year closing can be run again, but only the most recent closing entry will remain in the transactions. All dimensions from profit and loss must carry over into the retained earnings. All future and previous periods must have an On Hold status.

Solution:

Configure General ledger parameters.

–

Set the Delete close of year transactions option to Yes.

–

Set the Create closing transactions during transfer option to Yes.

–

Set the Fiscal year status to permanently closed option to No. Define the Year-end close template.

-Designate a retained earnings main account for each legal entity.

–

Set the Financial dimensions will be used on the Opening transactions option to No.

–

Set the Transfer profit and loss dimensions

Correct Answer: A

Q-5

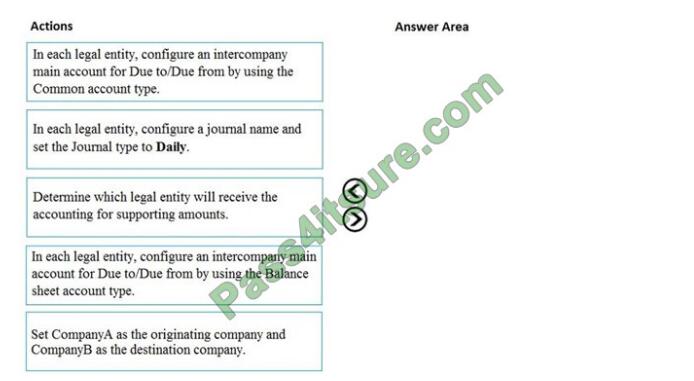

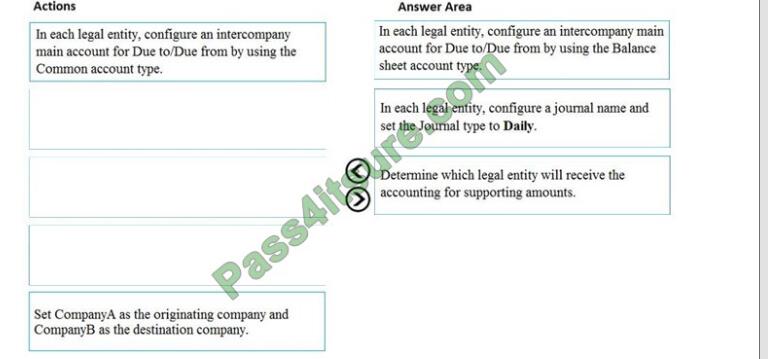

DRAG DROP

You are configuring a Dynamics 365 Finance environment for intercompany accounting. You create the following legal entities:

Company A

Company B

You need to configure intercompany accounting for both legal entities. Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order. NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

Correct Answer:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/intercompany-accounting-setup

Q-6

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear on the review screen. A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions. The client has the following requirements:

1. Only expense accounts require dimensions posted with the transactions.

2. Users must not have the option to select dimensions for a balance sheet account.

You need to configure the ledger to show applicable financial dimensions based on the main account selected in a journal entry.

Solution: Configure two account structures: one for expense accounts and including applicable dimensions, and one for balance sheet and excluding financial dimensions. Does the solution meet the goal?

A. Yes

B. No

Correct Answer: A

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures

Q-7

A company has many customers who are not paying invoices on time. You need to use the collection letter functionality to manage customer delinquencies. What are two possible ways to achieve the goal? Each correct answer presents part of the solution. NOTE: Each correct selection is worth one point.

A. Cancel the collection letters after they are created and posted.

B. Print all of the collection letters.

C. Delete the collection letters after posting when an error occurs.

D. Post the collection letters.

Correct Answer: BD

Reference: http://d365tour.com/en/microsoft-dynamics-d365o/finance-d365fo-en/collection-letters/

Q-8

You are configuring account structures and advanced rules in Dynamics 365 Finance. All balance sheet accounts require Business Unit and Department dimensions. The Shareholder distribution account requires an additional dimension for the Principal. You need to set up the account structures.

What are two possible ways to achieve the goal? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. Create a new main account for each of the company\\’s principals. Then, create an account structure for all balance sheet accounts that includes the required dimension.

B. Create a new main account for Shareholder distribution. Add an advanced rule for the Principal dimension.

C. Create an account structure for all the balance sheet accounts. Set up an advanced rule for the Shareholder distribution account for the Principal dimension.

D. Create an account structure for balance sheet accounts without Shareholder distribution. Then, create a second account structure for Shareholder distribution that includes all required dimensions.

Correct Answer: CD

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures

Q-9

You are setting up the Accounts payable module and vendor invoice policies for an organization. You need to set up vendor invoice policies that run when vendor invoices are posted in the system. In which two ways can you set up the policies? Each correct answer presents a complete solution. NOTE: Each correct selection is worth one point.

A. Set up invoice matching validation for vendor invoice policy.

B. Configure the vendor invoice workflow to run the policies.

C. Run the policies when you post a vendor invoice by using the Vendor invoice page and when you open the Vendor invoice policy violations page.

D. Apply the policies to invoices that were created in the invoice register or invoice journal.

Correct Answer: BC

Reference: https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/key-tasks-vendor-invoice-policies

Q-10

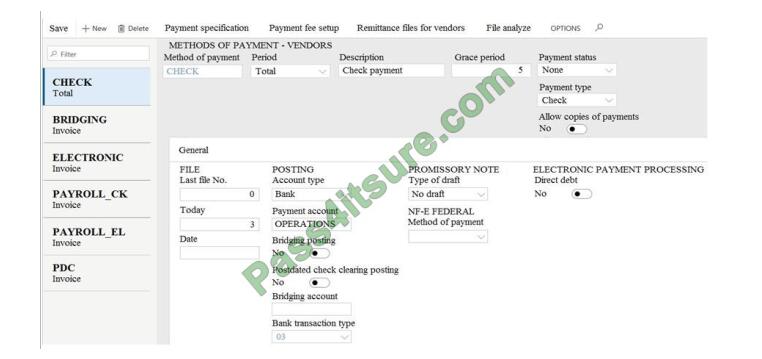

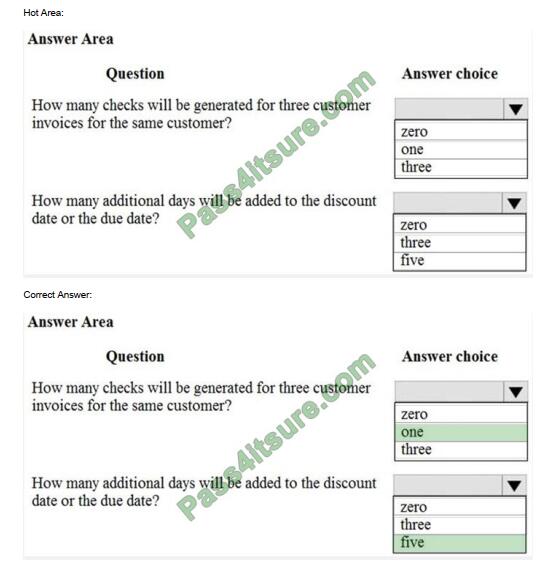

HOTSPOT

You are asked to configure the method of payment for vendors. You are viewing an Accounts payable method of payment. Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Q-11

You are configuring vendor collaboration security roles for external vendors. You manually set up a vendor contact. You need to assign the Vendor (external) role to this vendor. Which tasks can this vendor perform?

A. Request a new user account for a contact person by using the Provision user action.

B. Maintain vendor collaboration invoices.

C. Delete any contact person that they have created.

D. View and modify contact person information, such as the person\’s title, email address, and telephone number.

Correct Answer: B

Q-12

SIMULATION

You are a functional consultant for Contoso Entertainment System USA (USMF). You need to implement a quarterly accruals scheme for USMF. The accrual scheme settings must match the settings of

the monthly and annual accrual schemes. To complete this task, sign in to the Dynamics 365 portal.

Correct Answer:

Look at the monthly and annual accrual scheme settings. Create a quarterly accrual scheme with the same settings by using the following instructions:

1. Go to Navigation pane > Modules > General ledger > Journal setup > Accrual schemes.

2. Select New.

3. In the Accrual identification field, type a value.

4. In the Description of accrual scheme field, type a value.

5. In the Debit field, specify the desired values. The main account defined will replace the debit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

6. In the Credit field, specify the desired values. The main account defined will replace the credit main account on the journal voucher line and it will also be used for the reversal of the deferral based on the ledger accrual transactions.

7. In the Voucher field, select how you want the voucher determined when the transactions are posted.

8. In the Description field, type a value to describe the transactions that will be posted.

9. In the Period frequency field, select how often the transactions should occur.

10. In the Number of occurrences by period field, enter a number.

11. In the Post transactions field, select when the transactions should be posted, such as Monthly.

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/create-accrual-schemes

Q-13

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear on the review screen. A customer uses Dynamics 365 Finance. The customer creates a purchase order for the purchase of $20,000 in office furniture.

You need to configure the system to ensure that the funds are reserved when the purchase order is confirmed. Solution: Configure item posting groups for purchase requisitions. Does the solution meet the goal?

A. Yes

B. No

Correct Answer: B

See more Microsoft MB-310 exam questions on this website.